Understand why you should avoid probate and learn the best probate avoidance methods, like living trusts, beneficiary designations, POD accounts, and more.

Probate is the court-supervised process of carrying out a deceased person's will. This process involves submitting the will to the court, identifying and collecting the person's assets, paying any outstanding debts and taxes, and finally distributing the remaining property according to the will's terms. Many people ask, "Does a will avoid probate?" The answer is no. A will must go through probate before assets can be distributed to beneficiaries.

Fortunately, there are several ways to transfer property without going through probate. These include revocable living trusts, joint tenancy, transfer-on-death deeds, and pay-on-death beneficiary designations. Assets passed through these methods go straight to your chosen beneficiaries, no court needed.

This article explains why you might want to avoid probate and describes the main ways to do it.

- Why Avoid Probate?

- Avoiding Probate With a Living Trust

- Avoiding Probate With Beneficiary Designations

- Avoiding Probate With Transfer on Death Deeds

- Avoiding Probate With Transfer-on-Death Registration of Securities

- Avoiding Probate with Transfer-on-Death Registration for Vehicles

- Avoiding Probate With Rights of Survivorship

- Avoiding Probate by Making Gifts

- Simplified Probate Proceedings

- Learn More About Wills and Estate Planning

Why Avoid Probate?

For straightforward situations, probate comes with several disadvantages and very few benefits. It is often expensive, requiring payments to attorneys, appraisers, accountants, and the court itself. Depending on your state, probate fees can consume anywhere from 2% to 6% of the estate's value, leaving less for your beneficiaries. If the estate is complex, these costs can be even higher.

Besides being costly, probate can take a long time. In many states, it may last a year or more. During this period, beneficiaries usually do not get any inheritance unless the court authorizes a small "family allowance" for urgent needs.

If you own real estate in more than one state, your heirs may have to go through probate in each state. This usually means hiring more lawyers and paying for more court processes, which adds to the burden on your family.

For families that have simple distributions to make, probate is often more trouble than it's worth. If an estate includes common assets like a house, stocks, bank accounts, a small business, or cars, and there are no disputes, the property simply needs to be transferred to the new owners. In these cases, probate is often just repetitive paperwork, with lawyers acting more like costly clerks than true advisors.

Avoiding Probate With a Living Trust

A trust is a legal arrangement where one person, the trustee, holds property for the benefit of another, the beneficiary. Many people use living trusts to avoid probate because a living trust is set up during your lifetime and allows your assets to pass directly to your beneficiaries without court involvement. Also known as an inter vivos or revocable living trust, this type of trust can be changed or canceled at any time. You may create a living trust just for yourself or share one with your spouse or partner.

How a Living Trust Works

A living trust works much like a will because it lets you leave your property to the people you choose. But since the trustee legally owns the property, those assets can skip probate when you die.

When you create a living trust, you name yourself as trustee and transfer ownership of property into the trust, maintaining complete control. You retain the ability to manage, add, or remove assets, change beneficiaries or successor trustees, and even revoke the trust if you wish.

If you and your spouse or partner create a trust together, both of you must agree to any changes. However, either of you can cancel the whole trust at any time.

When you die, the person you named as successor trustee takes over. They are responsible for giving the trust property to your chosen beneficiaries, such as family, friends, or charities, following your instructions. Since these assets are already in the trust, probate isn't needed. Usually, the process takes only a few weeks, and the trust ends after everything is distributed.

When You May Not Need a Living Trust

Sometimes, a living trust might be more than you need:

If you expect to have a long life ahead. If you're healthy, a simple will and basic probate-avoidance options—such as joint tenancy or pay-on-death accounts, discussed below—are often sufficient, allowing you to postpone more complex planning.

Your estate is small. Very small estates may qualify for simplified probate, which is covered below. As your estate grows, potential probate costs increase, and simplified probate may no longer be available, so it's wise to ensure that major assets like real estate or business interests are structured to avoid probate.

You can avoid probate with other methods. Many assets, including bank and retirement accounts, can pass outside of probate without a trust. Check out the other probate avoidance options in this article before deciding if you need a living trust.

You Still Need a Will

A living trust doesn't fully replace your will, so it's important to have both. You need a will to name a guardian for your minor children and to cover any property not included in the trust. For example, if you receive new assets or inherit property after setting up your trust, these aren't covered unless you add them. Since it's hard to know what you'll own later in life, having both a will and a living trust makes sure all your wishes are met.

Avoiding Probate With Beneficiary Designations

One simple way to avoid probate is to directly name a beneficiary for certain assets, including life insurance policies, retirement plans, and even some bank accounts. Designating a beneficiary means that the assets can be transferred directly to your chosen recipient without the involvement of the probate court.

Payable-on-Death Bank Accounts

You can easily avoid probate on bank accounts by setting up a payable-on-death (P.O.D.) account. Just fill out a form at your bank to state who should get the money when you die. While you're alive, the beneficiary has no rights to the account; you can spend the money, change the beneficiary, or close the account whenever you want. After your death, the beneficiary shows proof of your death and their ID to the bank to claim the money, with no probate needed.

Retirement Plans

Retirement accounts like IRAs and 401(k)s can skip probate if you name a beneficiary. When you do, these funds go straight to that person without any probate process.

Life Insurance

Life insurance proceeds don't go through probate unless you name your estate as the beneficiary. While some people do this to provide quick cash for paying debts and taxes, it is generally not recommended because it defeats the goal of avoiding probate.

Avoiding Probate With Transfer on Death Deeds

In most states, you can make a transfer-on-death deed for your real estate, like a house or land, so it goes straight to your chosen beneficiaries without probate. Like any deed, it needs to be prepared, signed, notarized, and recorded with the county. Unlike a regular deed, you can cancel a transfer-on-death deed anytime, and it should clearly say it only takes effect when you die.

Avoiding Probate With Transfer-on-Death Registration of Securities

In most situations, you can name a beneficiary to inherit your stocks, bonds, or brokerage accounts without probate. It works much like a payable-on-death bank account. When you register your securities with your broker or the company, you can hold them in "beneficiary form," so the beneficiary's name is on the ownership documents.

While you're alive, the beneficiary has no rights to the securities. You keep full control and can sell, transfer, or change the beneficiary whenever you want. After your death, the beneficiary can claim the securities outside probate by showing proof of your death and their ID to the broker or transfer agent.

Avoiding Probate with Transfer-on-Death Registration for Vehicles

In many states, you can name a beneficiary right on your car's title or title application, so the car goes to that person without probate. These rules often apply to boats and motorcycles, too.

The beneficiary has no rights to the vehicle while you're alive. You can sell it, give it away, or change the beneficiary at any time. To set this up, just apply for registration in "beneficiary form." The new title will list your chosen beneficiary, who will automatically get the vehicle when you die. For more details, check with your state's motor vehicles department.

Avoiding Probate With Rights of Survivorship

Another common way to avoid probate is to own property with a right of survivorship. This is often used for real estate or bank accounts shared by spouses. When one owner dies, their share automatically goes to the surviving owner.

Joint Tenancy

Joint tenancy lets two or more people own property together, usually in equal shares, depending on state law. When one joint tenant dies, their share automatically goes to the surviving owner through the "right of survivorship." This avoids probate and only needs minimal paperwork to transfer ownership.

A will does not override joint tenancy. Even if your will says your share should go to someone else, the surviving joint tenants will inherit it. However, you can end joint tenancy during your life by transferring your share to someone else, or in some states, to yourself in a different ownership form.

Joint tenancy is often a good choice for couples buying real estate or other big assets together, since the property goes straight to the surviving owner when one person dies. But unlike a living trust, probate is only avoided after the first owner's death, not when the last surviving joint tenant dies.

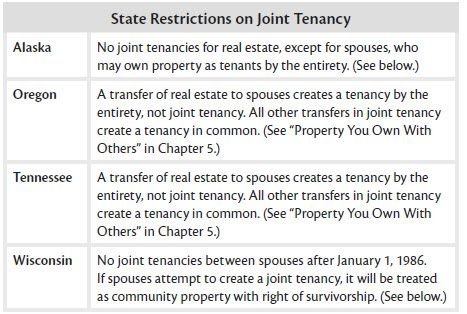

Several states have abolished or restricted the use of joint tenancy.

Tenancy by the Entirety

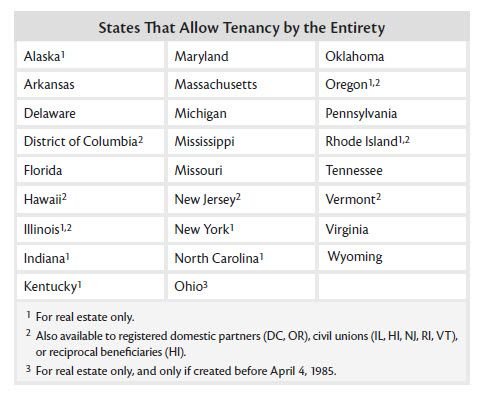

Tenancy by the entirety is a type of property ownership much like joint tenancy, but it is available in only about half of the states and is limited to married couples or, in some states, registered same-sex partners.

Tenancy by the entirety has many of the same pros and cons as joint tenancy and works best when a couple buys property together. When one spouse or partner dies, the surviving owner automatically gets the property, skipping probate.

Unlike joint tenancy, neither owner can transfer their share on their own, either while alive or through a will or trust. The property must go to the surviving co-owner. In joint tenancy, an owner can transfer their share to someone else while still alive.

Community Property With Right of Survivorship

Most states that allow married couples to own property as community property also allow them to agree that when one spouse dies, the deceased spouse's community property should automatically transfer to the surviving spouse without probate.

In some states, you can create this type of ownership by using the phrase "community property with right of survivorship" (or something similar, depending on the state) on a deed, a transfer document, or an account registration. In other states, you can agree to leave community property to a surviving spouse without probate by making a written agreement.

If this interests you, get help from a knowledgeable estate planning attorney who can help you weigh the pros and cons of survivorship in community property. A good attorney will also know the correct terminology and formalities required by your state.

Avoiding Probate by Making Gifts

You can also avoid probate by giving away property before you die because assets you no longer own aren't subject to probate. Making gifts can be a helpful estate planning tool, but large gifts may be subject to federal gift tax. If you want to give away a lot, it's smart to talk to an estate planning attorney to make sure the strategy fits your overall plan.

Simplified Probate Proceedings

Almost every state has some kind of simplified probate, often called summary probate, or an out-of-court transfer process for certain cases. Small estates usually qualify for these easier procedures, but what counts as a "small estate" varies widely by state. For example, in Kentucky, the current limit is $10,000, while in California, it's more than $180,000.

Even if the overall estate is too big to qualify, heirs can sometimes use these simpler processes if the part going through probate is under the state's limit. In many states, beneficiaries can claim personal property (anything except real estate) by providing a sworn statement and proof of their right to inherit, like a death certificate and a copy of the will. Some states also let a surviving spouse skip probate if they inherit less than a certain amount.

Learn More About Wills and Estate Planning

Avoiding probate can save your loved ones time, money, and stress during a tough time. By learning about tools like living trusts, beneficiary designations, joint ownership, and simplified probate, you can create an estate plan that fits your needs and goals.

The articles below can help you learn more about estate planning:

- What Happens If You Die Without a Will?

- What to Include in a Will: Assets and Property

- Setting Up a Child's Trust

- How to Reduce Estate Tax

You can find out more about making WillMaker's will and living trust in WillMaker's Legal Manual.

- Why Avoid Probate?

- Avoiding Probate With a Living Trust

- Avoiding Probate With Beneficiary Designations

- Avoiding Probate With Transfer on Death Deeds

- Avoiding Probate With Transfer-on-Death Registration of Securities

- Avoiding Probate with Transfer-on-Death Registration for Vehicles

- Avoiding Probate With Rights of Survivorship

- Avoiding Probate by Making Gifts

- Simplified Probate Proceedings

- Learn More About Wills and Estate Planning