The Uniform Transfers to Minors Act (UTMA) allows you to name a custodian to manage property you leave to a minor. The management ends when the minor reaches age 18 to 30, depending on state law.

The UTMA is a model law proposed by a group of legal scholars—and states are free to adopt it into their own statutes or not. When states have adopted UTMA, they often make small changes to it, like varying the age at which the custodianship ends. To date, every state except South Carolina has adopted the UTMA.

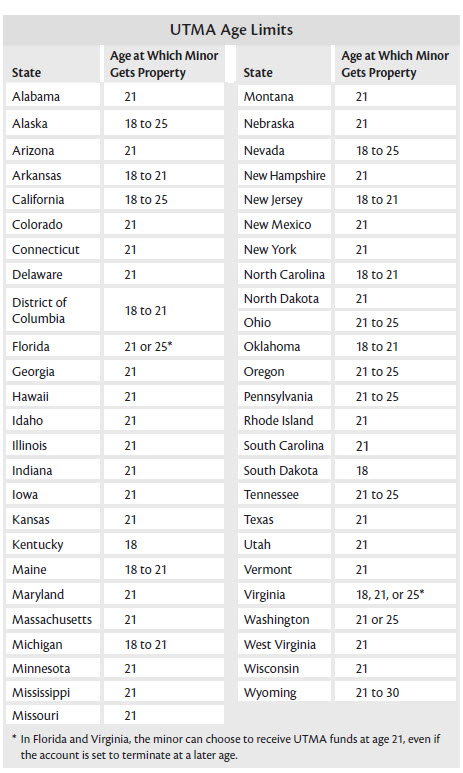

When you make your will with WillMaker, you can use either UTMA or a child's trust to provide property management for young beneficiaries of your will. If you choose to use UTMA, you will specify a custodian who will manage property. When the young person reaches a state-determined age – usually 21, but sometimes as young as 18 or as old as age 30—he or she will receive the property outright. (See below for your state's age or age range.)

Naming a Custodian

The custodian you name will manage and spend the property for the benefit of the young beneficiary until he or she becomes the age specified in your will.

The custodian you name should be reliable, honest, and capable of prudently managing resources. He or she should also live near the child.

If possible, you should name the person who will be the child's personal guardian. This will often be the child's other parent. If the other parent isn't available or can't be trusted to manage the child's property, name another adult who could handle the job -- preferably one who can work well with the person you've chosen to be the child's guardian.

Under the UTMA, you must name a person, not an institution, to manage the minor's property.

Be sure to speak with your choice and get consent before you name him or her as custodian.

Naming an Alternate Custodian

It is not necessary to name an alternate custodian, but it is a good idea. If your first choice is not available and you haven't chosen an alternate, a judge will appoint a custodian. This will cost time and money, and you will no longer be able to influence who will manage the child's property.

The same considerations for your first choice apply when choosing an alternate custodian.

Age of Termination

When the young person reaches the age you state in your will, he or she will get the remainder of your gift outright, and the custodianship will end. In some states, the age is set. In other states, the person setting up the custodianship (you) can choose an age within a range or between two options.

Here are the ages of termination by state.

If your state allows you to choose an age, consider the amount of money involved, the beneficiary's likely level of maturity as a young adult and the degree to which the property you're leaving will require sophisticated management.

If you would prefer the beneficiary to receive the property at an older age than allowed by your state, go back to the interview and choose to set up a child's trust instead of the UTMA. Using a child's trust you can provide property management up to age 35.

----------------------

Florida and Virginia Have Unique UTMA Rules

In Florida and Virginia, you can create an UTMA custodianship that will end when a young beneficiary reaches 25. However, if you choose age 25, the custodian must give the beneficiary the opportunity to terminate the custodianship (and receive custodial property outright) within a month of the beneficiary's 21st birthday. In other words, even if you want a young beneficiary's property management to end at age 25, the beneficiary can choose to take the gift four years earlier. To avoid this possibility, use a child's trust instead, or get help from an experienced Florida or Virginia estate planning attorney. (Fla. Stat. § 710.123, Va. Code § 64.2-1908 and § 64.2-1919.)

The Language in Your Will

Here is a sample of the language that will appear in your will if you choose to use UTMA for property management:

- All property left in this will to [name of beneficiary] shall be given to [name of custodian] as custodian under the [state name] Uniform Transfers to Minors Act, to be held until [name of beneficiary] reaches age [age]. If [name of custodian] is unwilling or unable to serve as custodian of property left to [name of beneficiary] under this will, [name of alternate custodian] shall serve instead.

Explaining Your Decisions

If you want to explain the choices you make in your will, we suggest that you do so in a letter that you attach to the will rather than in the will itself. This avoids any chance that you will accidentally add confusing or conflicting language to your legal document. A letter to survivors is a good, informal way to share the thoughts and reasons behind your decisions. If you want to write one, at the end of the will interview, we offer guidance and examples to help you along.